14th October 2022

InMind: Luxury Auto Decision Journey in China

China’s luxury automotive market has been a historical battlefield for international and domestic car brands vying for dominance in this lucrative yet ultra-competitive arena. Although COVID-19 lockdowns in several major Chinese cities in the first half of 2022 have taken a serious toll on the industry with sales dropping to nearly zero, the market is still expected to deliver a 16% annual growth by hitting 1,600 billion RMB, a figure set to elevate to 1,889 billion RMB in 2027[1].

To secure a stronghold in the Chinese luxury auto market, brands are racing to scale their marketing operations: Rising homegrown brands such as NIO are leaning heavily into their local roots to entice Chinese car enthusiasts. Seasoned foreign carmakers (e.g., Audi, Mercedes-Benz, BMW, Lincoln, etc.) with a leg up on publicity and awareness are proactively targeting a younger demographic through experience-centered tactics. New energy vehicles such as Tesla continue to harness and prosper under the megatrend of sustainability.

Meanwhile, there has been an unprecedented shift in the mindset and behaviors of car buyers, whose media consumption patterns have become more diverse and fragmented. Thus, auto-related content is no longer limited to auto verticals but expands along with consumers’ behavior, into non-car-specific verticals such as social platforms, with its YoY growth rate reaching 147%[2] and 108%[3]respectively on Bilibili and Douyin.

To help brands stay relevant in China’s ever-evolving luxury automotive industry, Mindshare China has just completed our proprietary Decision Experiences Study to unlock meaningful consumer insights and tailored marketing and media strategies toward creating a tangible impact throughout the customer journey.

Below is a summary of the study’s key highlights:

Standing Out Along the Journey

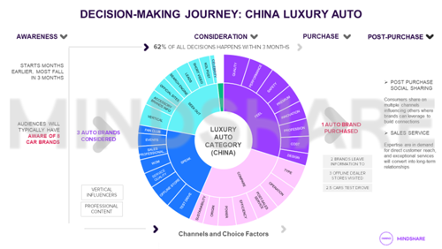

The commencement of the luxury automotive customer journey takes place way before the actual purchase: 62% of luxury car buyers, especially those aged 25-30, start to think about buying a car an average of 3 months before making the purchase decision. Similarly, entry-level luxury car buyers with vehicles valued at lower price points (below 350K RMB) often take longer in decision-making, given it‘s their first purchase and higher price sensitivity.

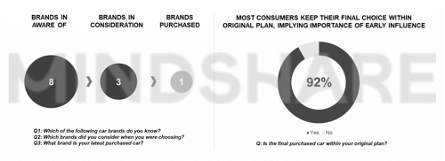

Another noteworthy insight is that on average, consumers typically become aware of 8 brands, 3 of which move into consideration and test drive, while obviously only 1 is purchased. What’s more, in the final buying choice, 92% of consumers stick to the original brand they had in mind, signifying a key priority for brands to maintain top-of-mind awareness with consistent messaging early in the customer journey.

Evolving Touchpoints

Consumers usually become aware of luxury car brands via offline stores (49%), professional advice (42%), word-of-mouth (32%), social (30%) and pop-ups (28%). When comparing different brands, they tend to turn to search engines and social media via influencers producing different types of content.

Women and young buyers tend to be more susceptible to the influence of social media at the beginning of their journey. Tapping into these insights, brands can leverage the launch of immersive outdoor car sale events for consumer education and lead generation throughout the decision funnel while implementing social activations on platforms like Douyin.

Content and Influencers

Young buyers tend to prefer new media such as livestream given their high affinity for this medium, while short videos and influencer promotion elicit a more positive response from high-end buyers.

With a massive presence on social media, professional advice is perceived as a potent information source by 61% of luxury car buyers during the consideration phase. Female buyers have expressed a pronounced interest in pan-entertainment content highlighting the prestige surrounding luxury auto ownership, while sustainability takes up significantly more headspace among the younger audience (TGI 〉 110).

Brands looking to leverage influencer marketing need to have a firm grasp on China’s automotive influencers, the makeup of which has expanded from an auto specialist majority to a diverse mix of lifestyle KOLs, tech CEOs, celebrities, etc. To reach a wider variety of audience with advanced articulation of car features, brands are strongly encouraged to think outside the box and explore various types of partnerships.

Purchase and Post-Purchase Behaviors

By the time they have visited an average of 3 stores for viewing and test drives, luxury car consumers are prepared to seal the deal: Offline sites remain the dominant platform as 90% of buyers complete their purchase at a 4s or brand store. In contrast, online channels are far less common as purchase points, with younger audience indicating the greatest openness toward this medium.

Post-purchase communication is yet another crucial facet that brands should take heed of given the amount of maintenance that’s going to be involved throughout the car’s lifespan, as well as the high probability of owners showcasing their purchase on social platforms. Brands need to set automated and personalized reminders to consistently engage with consumers across different car needs. Special events and services can also help to build community. For instance, young, female owners are more likely to amplify their luxury auto lifestyle through social media and online-and-offline events, presenting an excellent opportunity for brands to wield more word-of-mouth marketing power.

The luxury auto category in China has been undergoing remarkable disruptions in recent times, yet a growth rebound and an eventual spurt remain warranted in the long run. To stimulate sales and outsmart rivals, luxury car brands need to closely align their media and content strategies with the plethora of nuances across the consumer journey.

If you are a luxury automotive marketer who wants to know more about the study or are interested to know more about Mindshare’s insights reports, contact us at [email protected]. This study is confidential and proprietary and detailed sharing is at the sole discretion of Mindshare.

To learn more about Mindshare China, scan the QR code and follow our official WeChat account.