28th April 2020

Mindshare Tracker Reveals Insight into Possible Post COVID-19 ‘New Normal’ Behaviour

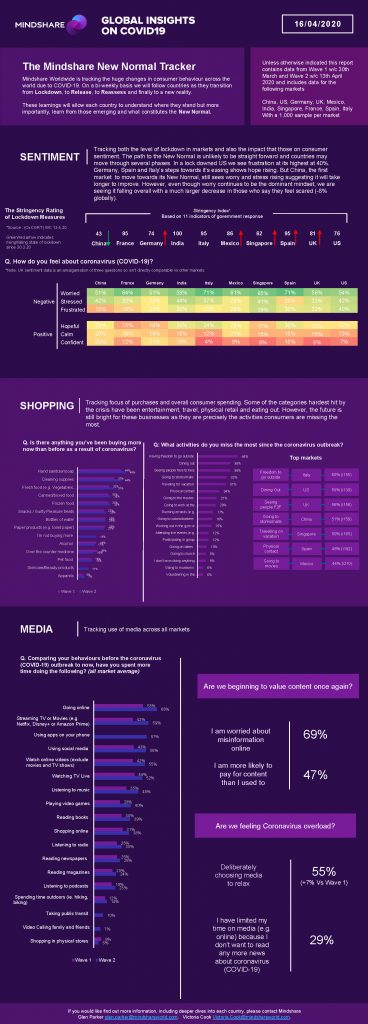

New York, Miami, London, Singapore, Shanghai, 16th April 2020: Mindshare, the agency network that is part of WPP, has released the second wave of its ‘New Normal’ COVID-19 tracker – a 1,000 person per market survey across 10 global markets that tracks changes in consumer behaviour in order to identify new behavious that may become the ‘new normal’ post COVID-19.

The ‘New Normal’ tracker, which covers China, US, Germany, UK, Mexico, India, Singapore, France, Spain and Italy, follows the impact on these societies as their countries transition from Lockdown, to Release, to Reassess and finally to a ‘New Normal’.

Wave 2 data - W/C 13th April - showed five key insights:

1. Cultural differences are important in context of the lockdown

2. Transition out of lockdown will be varied due to culture and infrastructure differences

3. People are concerned about their finances but are spending more on certain items

4. Online shopping is important but we crave physical commerce – more than physical contact

5. Media usage changes are largely as expected but may reverse after lockdown

1. Cultural differences are important in context of the lockdown

In a locked down US we see ‘frustration’ at its highest anywhere in the world, with 40% of respondents saying it is how they feel about their situation. Germany (16%), Spain (30%) and Italy’s (34%) steps towards easing restirctions is reflected in the fact that ‘hope’ as a sentiment is rising in those markets. In contrast, China, the first market to move towards the ‘New Normal’, still sees ‘worry’ (51%) and ‘stress’ (42%) rising, suggesting it will take longer to improve.

However, even though ‘worry’ continues to be the dominant mindset, we are seeing it falling overall with a much larger decrease in those who say they feel scared (-8% globally).

There is also a big variance in how the lockdown is being perceived by demographic, if we take the US as an example we can see that Generation Z is the most ‘overwhelmed’ (32%) and ‘lonely’ (25%) and women are over indexing for the most negative emotions across all demographics.

2. Transition out of lockdown will be varied due to culture and infrastructure differences

Different markets will come out of lockdown at different times, in different ways and with different measures in place - and this will play a part in how they recover. However, we can see that whilst markets are in lockdown, they can still be confident. Germany for example actually scores the highest for people who feel ‘confident’ at 26% even though at the time of the latest data collection (W/C 13th April) the country was still in full lockdown Vs Singapore at 5% and even China at 19%, both with less restrictions.

3. People are concerned about their finances but are spending more on certain items

There is no doubt that the global economic impact of COVID-19 and the governmental lockdowns to contain the disease have had an impact on how people view their finances and what they spend their money on.

Despite 55% of people saying they are ‘worryig a lot about my finances at the moment’, 33% said they are spending more on groceries than before, rising to 60% in India and China.

Whilst the segments that most reponsdents said they were spending more on than previously would seem obvious, such as hand sanitzer / soap (49%) and cleaning supplies (44%), there are also rises in fresh food (37%), snacks / guilty pleasures (29%) and skin care and beauty products (11%), with even apparel (7%) seeing a rise.

4. Online shopping is important but we crave physical commerce – more than physical contact

Shopping online is still higher amongst the younger age groups with only 24% of over 55s saying they are shopping more online compared to 45% amongst 25-34 (millennials roughly). While shopping online is now a normal behaviour for most people, physical shopping is still an activity that is missed, with 32% of people saying they most missed going to stores - that was more than missed ‘physical contact’ (24%), ‘attending live events’ (12%) or ‘going on dates’ (10%) when asked what they most missed since the coronavirus outbreak.

5. Media usage changes are as expected but may reverse after lockdown

More people are spending more time on TV (52%), Streaming (59%) and online (68%) as you might expect but these all require the extra time that we now have. Whether this behaviour will continue will be reflected in how each country comes out of lockdown. Interestingly, 32% of people are saying they are listening to less podcasts, whilst at the same time 30% of people say they are listening to more radio. This suggests that whilst people have more time, it isn’t always solo time and podcasts are generally individual media, whilst radio is the king of background and therefore we are seeing more people do that. When commuting returns though will podcast return?

For more information please contact Greg Brooks: +44(0)7826869312 | [email protected]

About Mindshare:

We were born in Asia in 1997, a WPP start up designed to make media exciting,

fun and life changing. For the last 20 years our values of Speed, Teamwork and

Provocation have guided us in a world where everything begins and ends in

media. We are the Cannes Lions Media Network of the Year 2019 and WARC

Media 100 #1 Media Network 2020, with the top 3 most creative campaigns of the

past year – so basically, statistically the best media agency in the world! Our

10,000 people work with some of the world’s best brands and companies to challenge

convention. In 116 offices across 86 countries we integrate brand and

demand, ruthlessly focus on outcomes and create the unexpected. We manage

$17.8bn in billings and are the largest media agency in GroupM, WPP’s Media

Investment Management arm, which is the #1 media holding group globally with

billings of $50bn (Source: COMvergence 2019).

Hear our stories (and join us) at www.mindshareworld.com and follow us at: WeChat ID: Mindshare_China; Instagram and Twitter: @mindshare; Facebook: facebook.com/mindshare and Linkedin: LinkedIn.com/company/mindshare.