22nd April 2020

Wave 6: Impact on brand loyalty

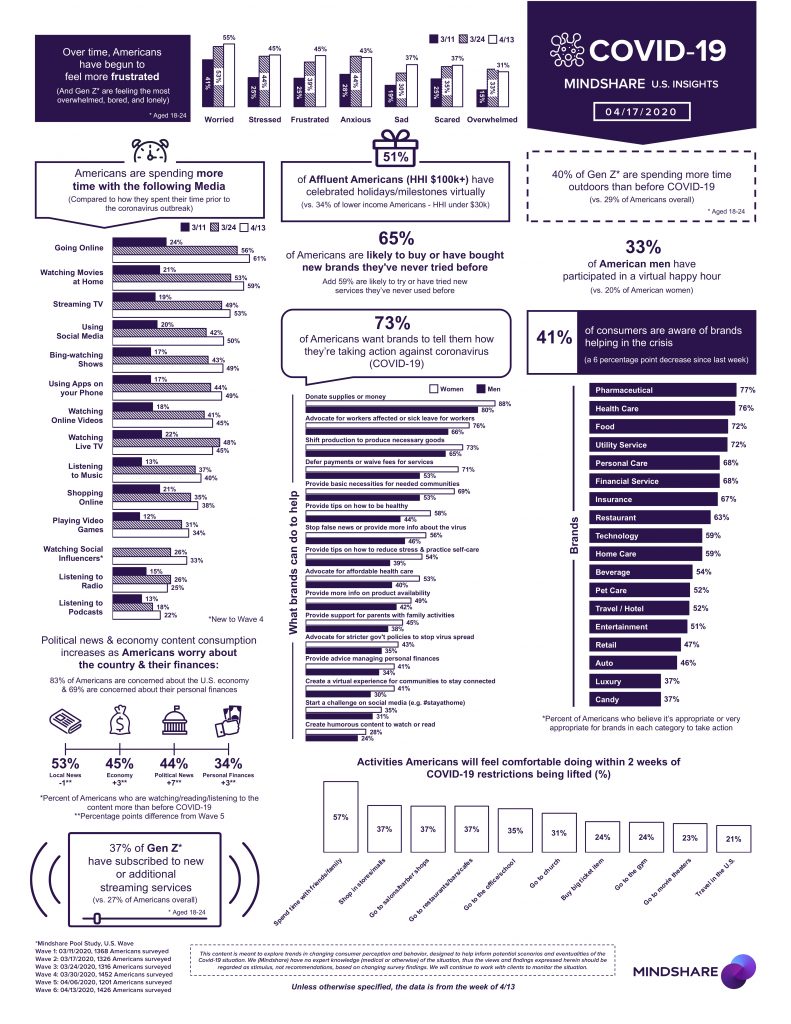

Our research shows that, in Wave 6 (W/C April 17), Americans continue to feel worried and stressed over the pandemic. 77% are concerned or very concerned about their health - of that, 47% are very worried. There are also concerns over the economy and the wider effects on society (74% in particular worry about the disruption on their everyday lives).

In week 6, over 1400 were surveyed as part of our regular COVID-19 research series, and it shows five key insights:

- Americans continue to feel worried and stressed over the COVID-19 pandemic, and frustrations are starting to rise as the weeks continue. Concerns over the economy, finances, and the wider effects on society, especially on their everyday life, are weighing on people.

- More Americans have reported self-isolating/quarantining this past week as it hits more regions, and continual increase in reduced spending, canceling trips, and delaying major purchases. Majority of Americans don’t believe that social distancing or stay at home orders should be lifted yet.

- How will the new normal look like after the pandemic is over? Americans report feeling the most comfortable seeing friends and family first when restrictions are lifted, and would likely do so immediately. Within the first month, Americans expect they’d feel comfortable shopping in stores, going to hair salons, going to out to eat, and returning to the office/school.

- With social distancing and stay at home orders continuing, COVID-19 has transformed physical spaces and interactions into virtual ones. As Americans spend less time together in physical spaces, loneliness is rising, with Gen Z feeling the most lonely.

- This week there was an uptick in political news as Bernie Sanders’ announcement and primary results were in the news. Continual increase in time spent with drama, comedy, and home content.

More takeaways and insights from MediaPost, diving into how the pandemic is impacting brand access:

Excerpt: Nearly two-thirds of American consumers say they miss one or more of the brands they haven't been able to buy during the pandemic, and they are buying new ones instead, according to a national survey conducted by Mindshare last week.

The findings -- which are the most recent of six weeks of weekly tracking studies conducted by Mindshare to understand how the pandemic is altering consumer sentiment, awareness and self-reported behaviors -- also found most consumers are likely to continue buying new brands (62%) or try new services (59%) even after the pandemic is over.

The responses suggest the pandemic may be more than just a momentary disruption in consumer brand access and/or preferences, but may be indoctrinating Americans to have long-term behaviors that threaten established brand loyalty.

The study also found that Millennials and affluent Americans are most likely to have tried or will continue to try new brands and/or services, and that Generation X-ers are most likely to continue buying new brands they have tried during the pandemic.

More generally, the study's sixth wave representing the week of April 13 found that Americans are more worried, sad, stressed and frustrated than at any point so far in the pandemic, but they are feeling slightly less anxious and overwhelmed.

Read the full piece in MediaPost,

More data and stats: