23rd October 2020

Wave 16: The election, shopping changes, travel, and more

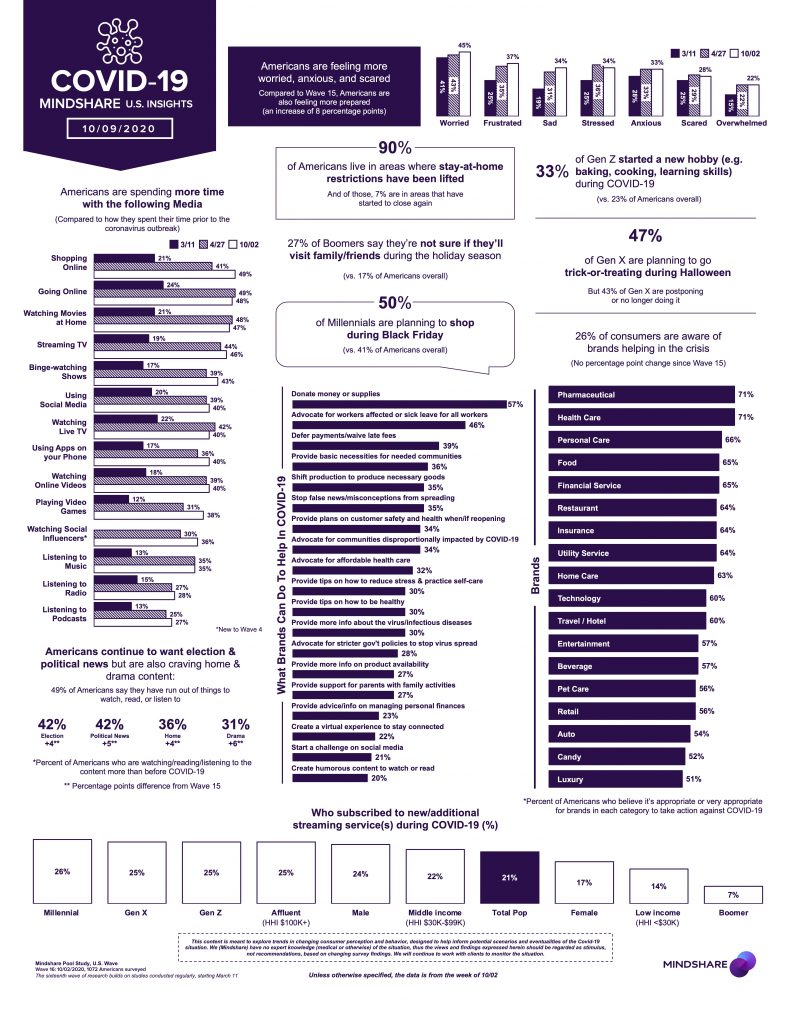

Wave 16 of our POOL research, which examines how COVID-19 is affecting consumer behaviors, media consumption, and more, took place W/C October 2, with 1,072 participants.

- Entering October, we see Americans' emotions become more negative after a respite last wave. As worry and frustration increase, so do concerns of the ongoing spread of COVID. Of all the issues facing Americans, this ranks highest in importance – though concerns about the economy, the election, and social justice issues remain.

- Americans are still spending more time consuming election and political content as we’re about less than a month out from the election. Many Americans support brands playing a role in American politics, but are hesitant over how. Key topics for concern surrounding the election are getting results in a timely manner, voter turnout, and making sure votes are being counted.

- The pandemic has largely impacted how Americans feel about travelling. Americans report feeling more comfortable traveling in a car over plane or public transit, and within their local area and to suburbs, rural areas over metropolitan or densely populated areas. They will likely continue to feel uncertainty over travelling until a vaccine is widely available.

- As COVID-19 continues into the holiday season, Americans are changing how they celebrate, whether it’s how they shop or if they’ll travel to spend time with friends and family. With Halloween coming up, they are split on participating with about half doing that while another half postponing or do not plan to trick-or-treat this year.

You can also see some more takeaways and insights, specific to consumers' reported spending habits on prescription medication and more in FiercePharma.

Excerpt: However, when analyzed by generation, 26% of millennials—compared with only 9% of baby boomers—said they expect to increase their spending. It's not that boomers will spend less; 85% expect to spend the same amount. They just aren't likely to buy more. For comparison, 41% of millennials expect to keep their spending steady.

Another part of the survey focused on Americans' opinions on brand involvement in taking action during COVID-19. Pharma and healthcare tied at the top of the list with 71% of respondents saying they should be involved. The study characterized involvement as donation of supplies, such as basic necessities for communities in need, safe plans for customers upon reopening and tips on how to be healthy during quarantine.

More stats and data: