3rd August 2021

‘Good Growth’ and ESG Deliver Financial Value

3rd August 2021: Integrated Analytics Consulting, Mindshare Worldwide

The importance of focusing on ‘good growth’ is increasing. Running a business sustainably, with a positive impact on wider society, is gaining more traction. Corporations are finding themselves under increased scrutiny from investors measuring their performance against Environmental, Social, and Governance (ESG) factors.

“An ESG strategy is no longer optional for listed companies. Consumers demand it from the products and services they purchase, investors require it in their portfolios, financing increasingly depends on it and employees want to work for a company that embraces it.” Investec

There is value in this ‘good’ way of doing business. The value of focusing on ESG is two-fold: from investors and consumers, both closely intertwined.

From an investor’s perspective, a higher ESG rating correlates with higher financial performance, and hence higher value delivery. Moreover, ESG-specific investment is growing.

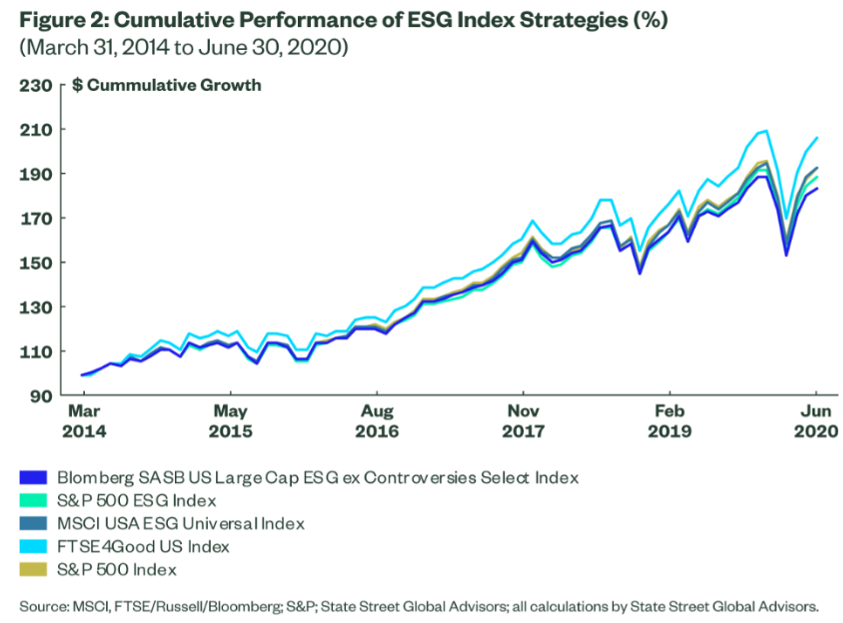

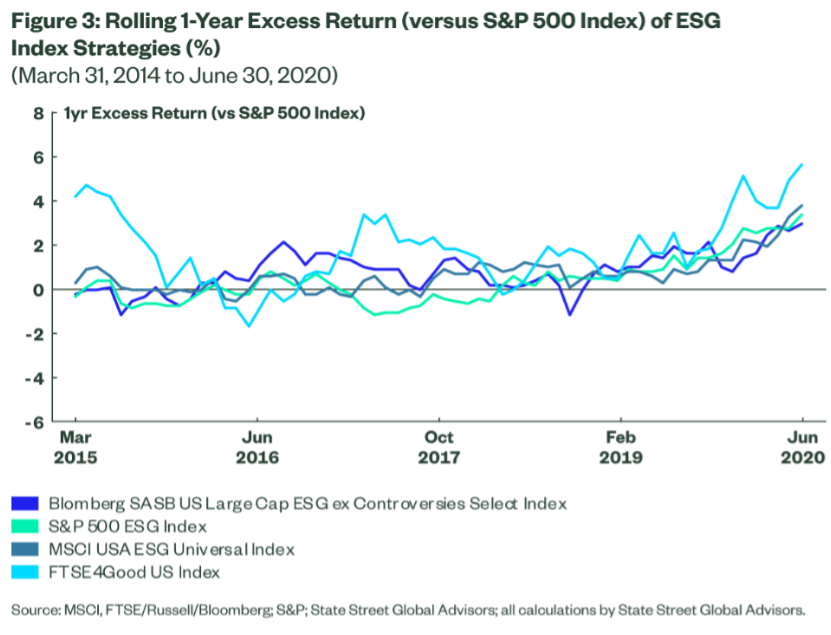

According to Refinitiv, companies with high ESG scores tend to have higher market value. J.P. Morgan states that “During 2020 there was growing evidence of positive correlations between ESG and financial performance”. Based on a study conducted by Probability & Partners in Europe, for every one extra point in ESG score cumulative excess return of the stock goes up by 8%. Multiple indices tracking stock performance of companies that score well in ESG practices have all seen increasing trends, with some outperforming one of the leading indices, the S&P 500 Index, within the past 7 years.

Moreover, stock indices of companies that do well in ESG typically see higher returns than the standard index benchmarks. This outperformance of benchmark indices varies per ESG index and can reach up to around 5%.

Furthermore, stocks of companies with a higher ESG rating tend to be less volatile, which helps to drive business resilience. More sustainable US firms with higher ESG ratings were more resilient during COVID-19 based on a recent Refinitiv study. It appears that “losses of companies with low ESG scores were 50% higher than those of highly ESG scoring companies”.

Additionally, “sustainable equity funds finished 2020 with a clear performance advantage relative to traditional equity funds”, reported Morningstar.

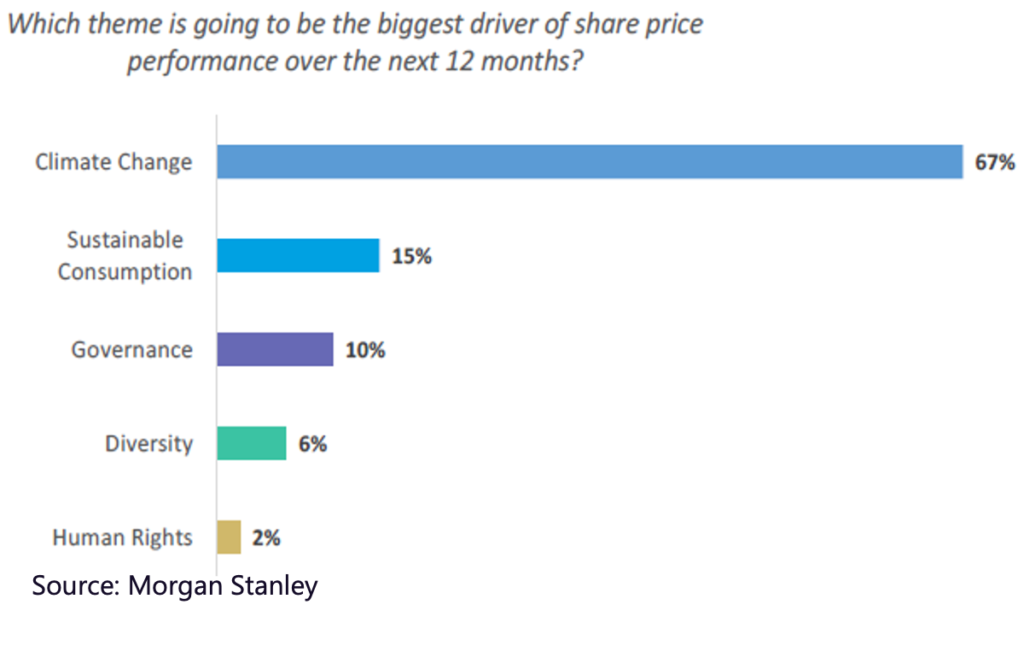

Some of the ESG factors have a stronger weight. The biggest driver of share price out of the ESG factors is climate change. Sustainable consumption, governance, and diversity are also important but their impact on share price is less significant, according to an investor survey conducted by Morgan Stanley. However, Kepler Cheuvreux states “Diversity is moving up investors’ lists of focus areas”. More work is to be done within this space though, as gender diversity, ethnicity and racial diversity are facing slow progress, with the latter two areas being “where least progress has been made”.

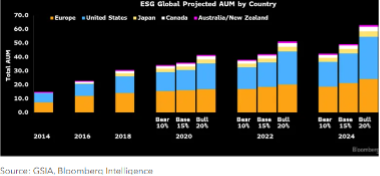

As a result, investors are switching to sustainable investment. Focus on investing in corporations run in a sustainable way and in line with the ESG principles has “gone from niche to normal”, claims FTSE Russell. ESG-specific investment is growing at rates over 20% per year.

“Opimas estimates that ESG based investing accounts for $40T (up from $12T in 2012) of the global AUM (Assets Under Management) base of $89T, which means that c. 45% of global AUM is now influenced by ESG principles”, states Investec. Bloomberg expects ESG AUMs to grow to nearly $60T by 2024, with the US and Europe being the main leaders.

Investors’ top three reasons for this ESG investment growth are: improved long-term returns, positive impact on their brand image and reputation, and reduced investment risk, according to Exane BNP Paribas.

A recent example of the importance of ESG is Deliveroo, a food delivery app. Deliveroo went public and started to trade on the London Stock Exchange on the 31st March 2021. Within the first minutes of trading its share price dropped by more than 30%. This was one of the steepest drops for a new listing in years and cost Deliveroo more than £2bn of their company value. A substantial growth in Deliveroo’s gross transaction value (up 130% YoY in Q1 2021) and growing orders (up 114% YoY in Q1 2021) would have made this a great IPO bet. However, ESG concerns hindered the success. Investors found Deliveroo a risky over-priced bet due to corporate governance concerns. Deliveroo has been publicly scrutinized over worker pay, employee working conditions and workers’ rights. Bloomberg reported that many investors were “concerned about the setup being exploitative, with many couriers reportedly earning an average income below the minimum wage”. Aberdeen Standard Investments commented "Deliveroo's narrow profit margins could be at risk if it is required to change its rider benefits to catch up with peers, in an industry that is already facing severe competitive pressure between the large tech platforms".

From a consumer perspective, consumer consciousness and choice are the main drivers of the importance of ESG. An increasing number of consumer choices are driven by ESG factors and ignoring consumer views can be costly. Jefferies Equity Research states "When you do not act and are misaligned to culture, you see a slow erosion of what was a strong consumer & customer base, and eventually you see that in revenues and efficacy of marketing dollars". Consumer consciousness is “increasingly determining product categories/brands opportunities and risks, and product innovation. This in turn could be having a material impact on financials and valuation”, according to J.P. Morgan.

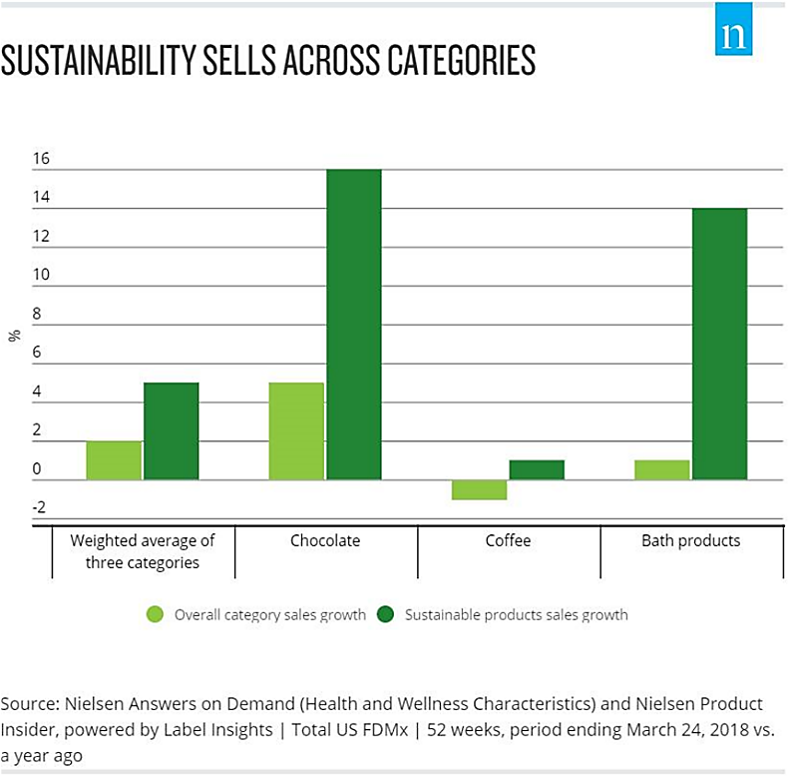

Sustainability has also been linked to increased growth in revenues. In a 2018 study, Nielsen compared the impact of different sustainability claims across three US product categories - chocolate, coffee, and bath products. The study showed that by weighted average, sales of products with sustainability claims grew 5% in the 52 week period analysed compared to 2% for the categories overall.

A US analysis from NYU Stern’s Center for Sustainable Business also confirms a positive link to sales growth. Looking at over 70,000 products from 2013 to 2018, the analysis concluded that 50% of the growth in consumer packaged goods in this period came from products with sustainability claims, even though these products accounted for only 16.6% of the market in 2018 (up from 14.3% in 2013). The study also found that products marketed as sustainable delivered nearly $114 billion in sales in 2018, up 29% from 2013.

Additionally, Unilever has also seen positive results of their sustainability efforts. In 2018, Unilever’s Sustainable Living products – including household heroes such as Dove – grew 69% faster than the rest of the business, accounting for 75% of the company’s overall growth. Last year, the Chief Sustainability Officer added that since 2014, Unilever’s Sustainable Living Brands have outperformed the average growth rate of the rest of the portfolio.

Sources: Bloomberg, J.P. Morgan, Morgan Stanley, FTSE Russell, MSCI, Investec, Kepler Cheuvreux, Jefferies Equity Research, Morningstar, Exane BNP Paribas, Aberdeen Standard Investments, Nielsen, Unilever, HBR, NYU Stern

For more information about this research contact:

[email protected] and [email protected]

Find out more about Good Growth.