5th May 2020

Mindshare New Normal Tracker Reveals Global Differences as More Countries Come Out Of Lockdown

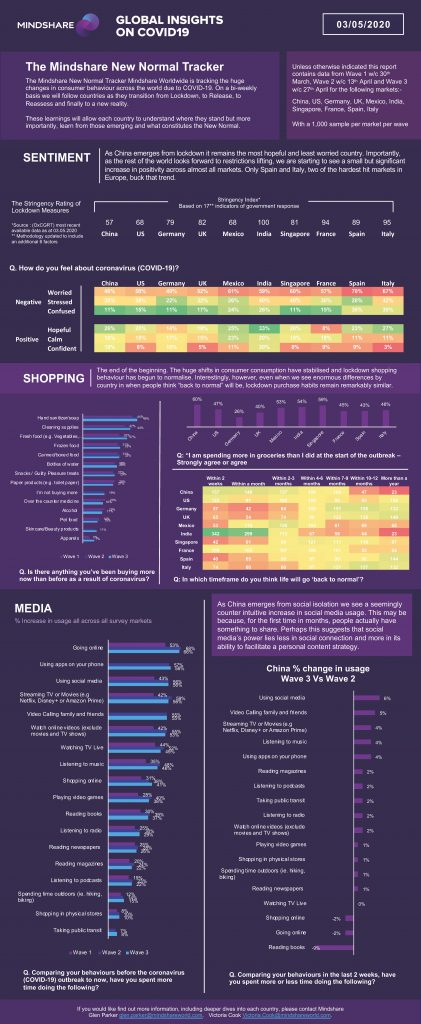

New York, Miami, London, Singapore, Shanghai, 5th May 2020: Mindshare, the agency network that is part of WPP, has released the third wave of its ‘New Normal’ COVID-19 tracker – a 1,000 person per market survey across 10 global markets that tracks changes in consumer behaviour in order to identify new behaviours that may become the ‘new normal’ post COVID-19.

Wave three data shows that whilst behaviours have stabilised, the emotional attitude towards the global crisis continues to change and as we start to see markets come out of lockdown we are starting to see bigger global differences.

Wave 3 data - W/C 27th April - showed key insights around consumer sentiment, shopping and behaviours.

Sentiment:

As lockdown continues for many markets we have seen a gradual decline in how ‘scared’ (-10%) people are, whilst the sentiment around ‘frustration’ (28%) and ‘loneliness’ (15%) are stable. People in China, which is out of lockdown, feel less worried than other nations (45% in China vs 58% globally) and there is ‘hope’ coming through in the places where lockdown seems to be working such as China (25%) and Italy (28%). However, Germans preparing to come out of lockdown still have lots of ‘doubt’ (35%) and ‘frustration’ is high across Europe. The tracker continues to show that women are more likely to be worried (61% vs 55%) and scared (32% vs 26%) and anxious (36% vs 29%) than men

Shopping:

Whilst people are still buying more than normal, that amount has stabilised but with key differences by market. Medicine has seen bigger increases in China (30%), India (31%) and Thailand (42%) compared to a global average of 18%. France (34%), Germany (37%) and Netherlands (43%) consumers however have not been buying more compared to the global average of 19%.

Behaviours:

Media behaviour has started to show a consist pattern of high online (66%) and streaming activity (56%). Shopping online continues to increase across the weeks (+10% from wave 1). While globally we are seeing the same dynamics, there are some variations by market. Live TV vs Streaming TV is different in many markets. France (50%), Spain (62%), and India (66%) buck the trend with Live TV increasing more than other markets. Spain (76%) is also calling friends and family more than any other market. Shopping online meanwhile is the lowest in France (21%) and Spain (35%).

What people are missing is showing bigger differences in the markets than the overall averages of going outside (44%), Dining out (36%) and seeing people face to face (36%). People in China most want to go to malls (48%), whilst in Germany people want to go on vacation (43%). In the Netherlands (29%) and Thailand (31%) people want to go to salons or barbers (more than the global average of 16%). Those in the US want to volunteer again (36% vs global of 6%) whilst Spain is missing physical contact the most (51%). Gender also shows differences in what we are missing with women more likely to miss seeing people (37% vs 32%), physical contact (30% vs 23%) and shopping (35% vs 29%).

For more information please contact Greg Brooks: +44(0)7826869312 | [email protected]

About Mindshare:

We were born in Asia in 1997, a WPP start up designed to make media exciting,

fun and life changing. For the last 20 years our values of Speed, Teamwork and

Provocation have guided us in a world where everything begins and ends in

media. We are the Cannes Lions Media Network of the Year 2019 and WARC

Media 100 #1 Media Network 2020, with the top 3 most creative campaigns of the

past year – so basically, statistically the best media agency in the world! Our

10,000 people work with some of the world’s best brands and companies to

challenge convention. In 116 offices across 86 countries we integrate

brand and demand, ruthlessly focus on outcomes and create the unexpected. We

manage $17.8bn in billings and are the largest media agency in GroupM, WPP’s

Media Investment Management arm, which is the #1 media holding group globally

with billings of $50bn (Source: COMvergence 2019).

Hear our stories (and join us) at www.mindshareworld.com and follow us at: WeChat ID:

Mindshare_China; Instagram and Twitter: @mindshare; Facebook: facebook.com/mindshare and Linkedin: LinkedIn.com/company/mindshare.